A Window of Opportunity? Vancouver’s Condo Market Swings Toward Buyers

In a city long defined by bidding wars, rapid price growth, and anxious open houses, a subtle but significant shift is underway in Vancouver’s condo apartment market. For the first time in recent memory, prospective buyers may find themselves with more leverage than they’ve had in years.

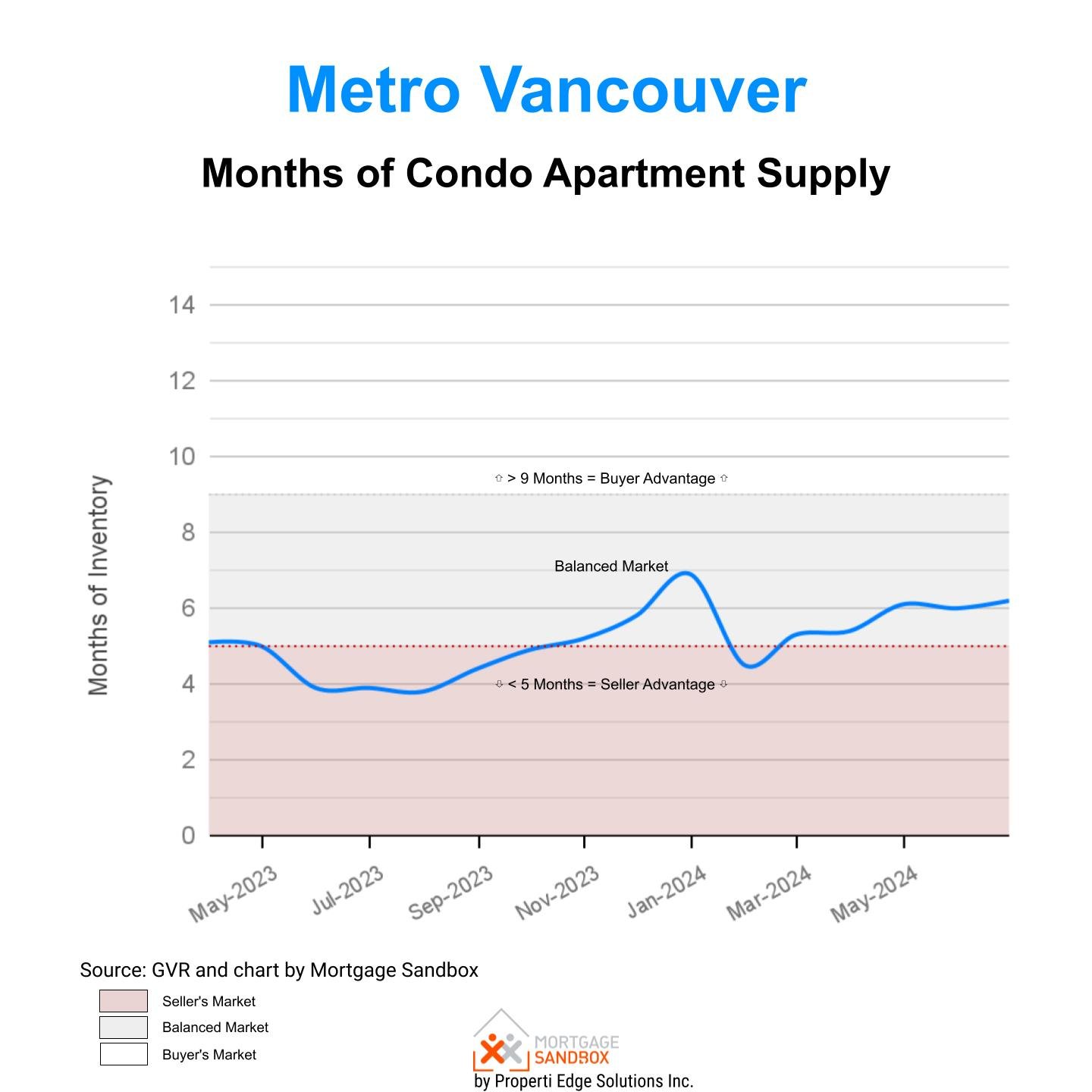

As of this spring, Vancouver's condo market is in what analysts define as a balanced market, a state in which buyers and sellers hold roughly equal negotiating power.

By the Numbers: Supply Up, Demand Down

According to the latest market figures, months of inventory, a key metric that measures the time it would take to sell all listings at the current sales pace, has almost doubled to 6.4, up from just 3.8 a year ago. That 68 percent jump indicates that properties are lingering longer on the market, giving buyers more time to make decisions and, crucially, to negotiate on price.

Purchase demand has declined by 7 percent, suggesting that higher interest rates, the trade war, and broader economic uncertainty are dampening enthusiasm among would-be homeowners.

The drop in demand is significant, only because 2024 demand was already very low compared to previous years.

Meanwhile, the number of active listings has increased by 48 percent, a significant surge that’s widening options for buyers and diluting competition among them.

For all the talk about a “glut of listings,” it’s essential to anchor expectations to the fact that this is what a balanced market looks like. Since Vancouverites have grown accustomed to a seller’s market, a balanced market feels like a lot of supply, when in fact, this should be what normal looks like.

Prices Hold, for Now

Despite these shifting dynamics, prices have remained surprisingly stable. The benchmark price for a condo apartment has stayed flat over the past three months, showing no immediate signs of dropping.

Prices have dropped 3 percent compared to April 2025 and 4% from the peak.

Flat values are a sign of market resilience for sellers; for buyers, they suggest that while they may have more room to negotiate, deep discounts remain elusive for now.

Some analysts view this price stagnation as a lagging response to broader market forces. Others argue it reflects the unique fundamentals of the Vancouver market, where scarcity of land, strong immigration flows, and sustained global interest provide a floor beneath falling demand.

Industry Asks for Government Help

Recently, Rennie, a condo-marketing company, announced layoffs of 31 staff. Real estate brokerages and developers are pleading for the government to help them cope with what they feel is a fundamental market imbalance. Their arguments have several weaknesses.

The market is balanced and shouldn’t require government intervention.

Montreal and Calgary markets are bustling and don’t face the same challenges as Vancouver, so a federal government intervention to help Vancouver might cause bubbles in Calgary and Montreal.

The government has been promoting the construction of supply and restricting foreign buyers to balance the market, and it appears they are achieving their policy aims.

Developers should have stress-tested their budgets for balanced markets; it’s not the taxpayers’ responsibility to bail them out when they take on too much risk.

During the pandemic, prices got out of hand and shot too far past local economic fundamentals, and perhaps the current market reflects a backward swing on the pendulum.

While the market was poised to have a better year in 2025 than in 2024, the US trade war has stifled its growth. Lower rates and taxpayer handouts will not solve the trade war and cajole buyers back into the market.

Higher Rates, Cooler Heads

Fixed Five-year Mortgage Rate Canada

The current market rebalancing comes against a backdrop of higher mortgage rates. Rates dropped to record lows as part of economic stimulus policies intended to support the Canadian economy during lockdown.

The higher rates and mortgage payments mean Canadians can’t afford to spend as much on housing, and unless there is a significant recession, we can’t expect rates to ever fall to the record lows again. This is the new normal.

If less borrowing capacity is holding buyers on the sidelines, and lower rates are not an option. Lower prices might be what is needed to bring buyers back into the market. Higher incomes would also do the trick. However, governments, sellers, and developers would have difficulty influencing those upward in the face of a trade war.

An Opening for Buyers?

The current slowdown may be especially attractive for buyers accustomed to Vancouver’s hypercompetitive condo scene.

More listings, longer selling times, and stable pricing present a rare chance to enter the market on less frantic terms. For these buyers, 2025 could offer the kind of conditions that have been largely absent for the past decade.

Developers might offer perks like a parking spot or storage locker rather than lowering prices, but pre-sale buyers should consider that new homes and pre-sales are charged 5 percent sales tax. A tax that is not levied on previously owned properties.

Timing the market remains notoriously difficult. Vancouver’s housing market has repeatedly defied predictions of downturns.

A Rare Moment of Balance

For now, the condo apartment market in Vancouver is best described as balanced, and the momentum is clearly edging further toward buyers. The increase in inventory, softening demand, and stable prices have created a narrow window of opportunity for those ready to make a move.

Whether this balance will hold, or quickly swing back toward sellers as it has in the past, remains uncertain. But in a city that rarely favours the buyer, the present moment may be as good as it gets for condo hunters looking to gain an upper hand.