Reigniting the Canada's Property Market Requires More Than Rate Cuts

After a bruising period of rate hikes and housing market stagnation, Canada's mortgage landscape has entered a new phase.

The Bank of Canada, having slashed its policy rate from a high of 5.00% in April 2024 to 2.75% by March 2025, has since held steady.

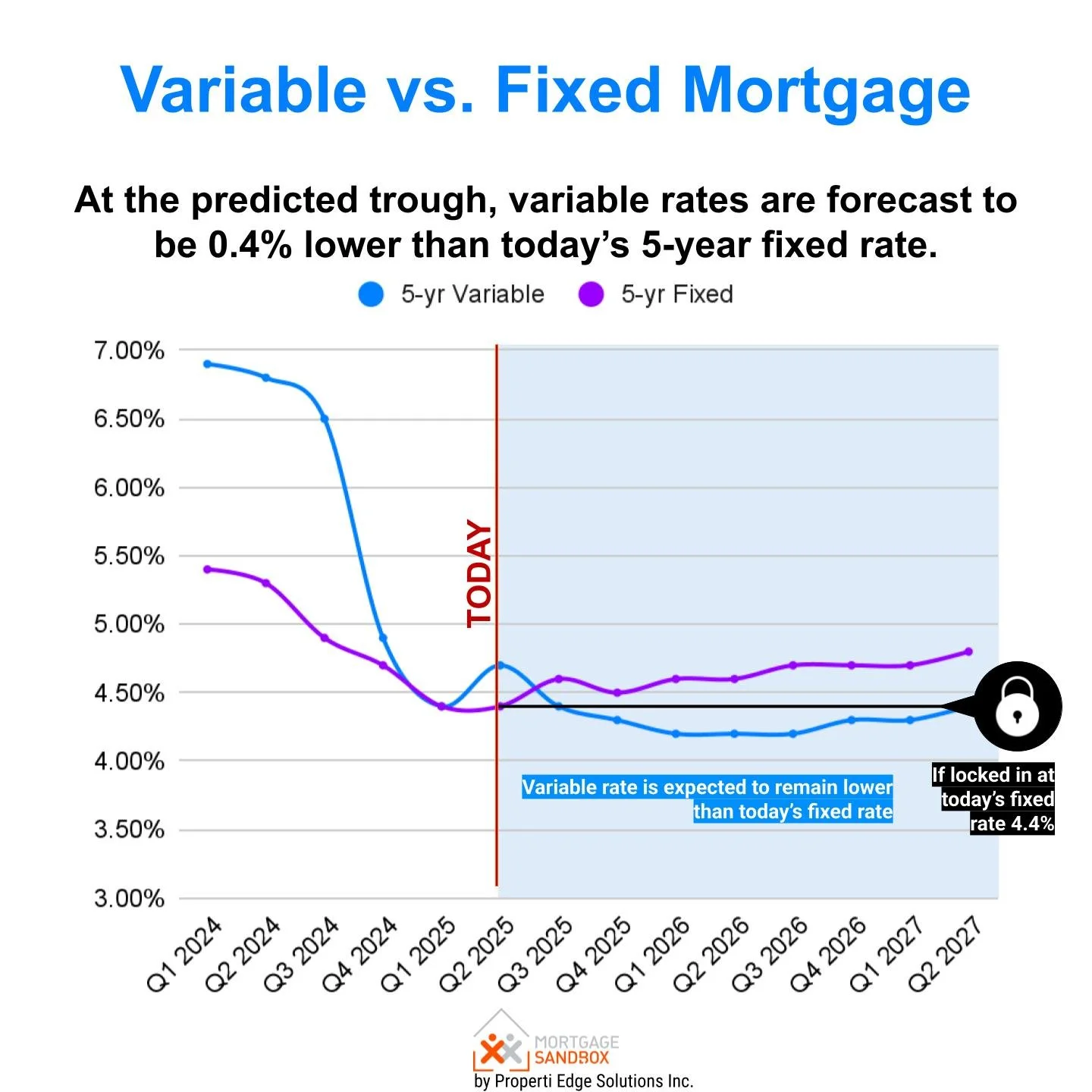

This brought the prime rate to 4.95%, anchoring variable mortgage rates. Fixed mortgage rates, although edging downward, remain tied to stubbornly high bond yields.

As of mid-July 2025, the lowest available five-year fixed insured mortgage rate sits at 3.84%, narrowly below the 3.95% variable rate.

This shift has yielded tentative signs of life. In May, national home sales rose for the first time in six months. Prices have begun to stabilize. Yet this is no re-run of the speculative surges seen in years past. For demand to re-ignite fully by December, more is needed than rate relief: confidence, regulatory clarity, and external stability all play pivotal roles. As well, in the more expensive markets, further downward price adjustments might be needed before most buyers are back in play. The ultra-low rates of the past decade may never return, and the market needs to adjust to this.

Regional Variation

The Bank of Canada's mandate is clear: control inflation and consider employment. It is not responsible for housing markets when setting rates.

Canada's housing situation is fragmented. While Toronto and Vancouver grapple with cooling markets, Edmonton and Montreal are booming. A federal "spray-and-pray" interest rate intervention to aid distressed markets risks creating bubbles in hot ones. Tailored, local solutions from provinces and municipalities, addressing specific supply and demand issues, offer a more effective path than broad federal action.

The Bank's Deliberate Turn

Having cut rates aggressively, 2.25% basis points in under a year, the Bank of Canada has now paused twice. The latest hold in June follows one in April.

While inflation has eased, core metrics remain sticky, particularly in housing-related categories. Shelter costs, up 4.5% year-on-year, and the mortgage interest cost index, up 6.2%, are still climbing.

This underscores the Bank's dilemma. While headline inflation, at 1.7%, justifies further cuts, underlying pressures advise caution. Complicating matters further, core measures of inflation stand near the upper acceptable boundary of 3.0%.

The Bank also faces external headwinds. Recent U.S. trade manoeuvres have introduced new uncertainties, prompting policymakers to proceed with care.

Rates Diverge: Fixed vs Variable

While variable mortgage rates closely follow the Bank of Canada's benchmark, fixed rates are governed by bond yields. These, in turn, are driven by investor sentiment, inflation expectations, and fiscal signals such as federal bond issuance. As a result, fixed rates remain elevated, limiting their decline despite the BoC's dovish tilt. The upshot is a curious inversion: fixed rates, typically higher, are now marginally cheaper than variable ones.

Economic Crosswinds

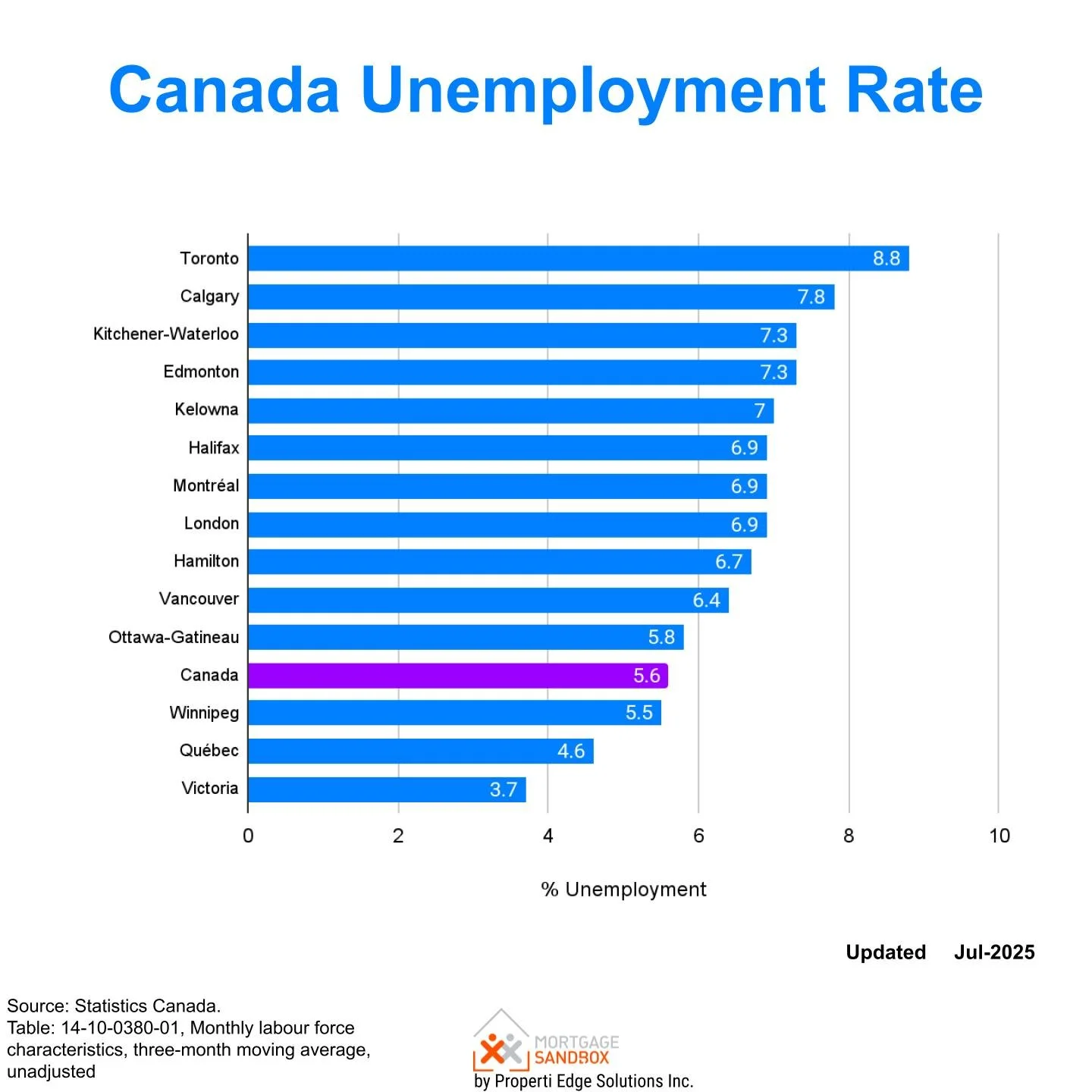

Canada's economic backdrop is mixed. Employment is robust: June saw 83,000 new jobs, nudging unemployment down to 6.9%. Yet wage growth has softened, and long-term joblessness remains elevated. Youth unemployment stands at 14.2%.

Inflation has moderated overall, but with uneven effects. Core inflation remains near the upper bound of the Bank's comfort zone.

Population growth, a key driver of housing demand, is slowing. The populations of B.C., Ontario and Quebec shrank between March and June 2025.

GDP growth is expected to rise modestly to 1.8% this year, driven in part by a rebound in residential investment. But consumption growth is likely to remain tepid, restrained by lingering debt loads and slower demographic expansion.

The Housing Market's Tentative Turn?

According to the Canadian Real Estate Association (CREA), in May 2025, national home sales rose for the first time in half a year. Their analysis sees that a turnaround could be in progress.

Prices stabilised: the MLS Home Price Index dipped just 0.2%, far less than prior months. Still, prices remain down 3.5% year-on-year, and the average home sold for $691,299, 1.8% below last May.

They note that inventory levels remain elevated in some markets, particularly in Ontario and British Columbia. and buyers remain cautious, wary of both rates and regulatory shifts.

| Jun-25 | Jun-24 | % Change | YTD 2025 | YTD 2024 | % Change | |

|---|---|---|---|---|---|---|

| Vancouver | 2,170 | 2,395 | -9% | 11,972 | 13,773 | -13% |

| Edmonton | 2,877 | 2,842 | 1% | 14,427 | 15,041 | -4% |

| Calgary | 2,286 | 2,737 | -16% | 12,404 | 15,141 | -18% |

| Toronto | 6,243 | 6,397 | -2% | 30,967 | 37,746 | -18% |

| Ottawa | 1,602 | 1,448 | 11% | 7,406 | 7,256 | 2% |

| Montreal | 4,385 | 3,798 | 15% | 26,264 | 23,298 | 13% |

Pulling in the June and year-to-date (YTD) data for major markets across Canada doesn’t paint the optimistic picture the real estate association was projecting.

The two largest markets are Toronto and Montreal. Toronto buyer activity is well below 2024, and Montreal is far above. This is an excellent example of where federal intervention to prop up Toronto’s market could cause a risk of a bubble in Montreal.

Of the other markets, Ottawa is up, Edmonton is roughly unchanged from a year ago, while Vancouver and Calgary are significantly slower this year.

On balance, there are few signs of a national turnaround in the property market.

A Cautious Outlook

The ingredients for a recovery are present: lower rates, stabilizing prices, and solid employment. But several caveats remain.

Fixed mortgage rates, which are used to calculate the amount Canadians can borrow on their mortgage, are significantly higher than pre-pandemic levels and are not expected to fall much further.

The speculative exuberance of past housing cycles is unlikely to return.